RSC Management Solutions

We Help You Take Control of Your Credit and Transform Your Financial Future

Credit Boost Guide: Unlocking The Code To Getting Your Home, Car, and High-Limit Cards

BONUS - Business Structure to get $100k in Funding

Introducing The Transform Your Wealth:

The Power of Credit, AI, and Leveraging Assets eBook!

It’s an action-based Masterbook that presents you with the most effective techniques and strategies used by the world's top Leading Successful Credit Entrepreneurs . Now, you have these tools at your disposal so that you can become an expert in identifying Tools To Leverage Credit and learning tactics in Disputing Errors yourself and understanding how AI Is Used To Effectively Turbocharge Your Life!

Limited Time Offer: Was $149.99! Now Only $29.99!

Here's what's included in the ebook

Credit Masterclass

AI insight

Asset Leveraging Strategies

Banking Relationships

OPM, OPA, OPR

Mindset Shift

Grab Your Copy And Implement This Action-Based Handbook To Master Your Personal Credit From Any Credit Standing Even If You're Just A Beginner!

YOU NEED TO SEE THE VALUE OF WHAT YOU'RE GETTING

Learn The SECRETS Of Multi-Millionaires Quickly UNLOCK Your Path To Unprecedented Wealth Without Having To Be An EXPERT Or Spend Thousands Of Dollars On Interest and Fees.

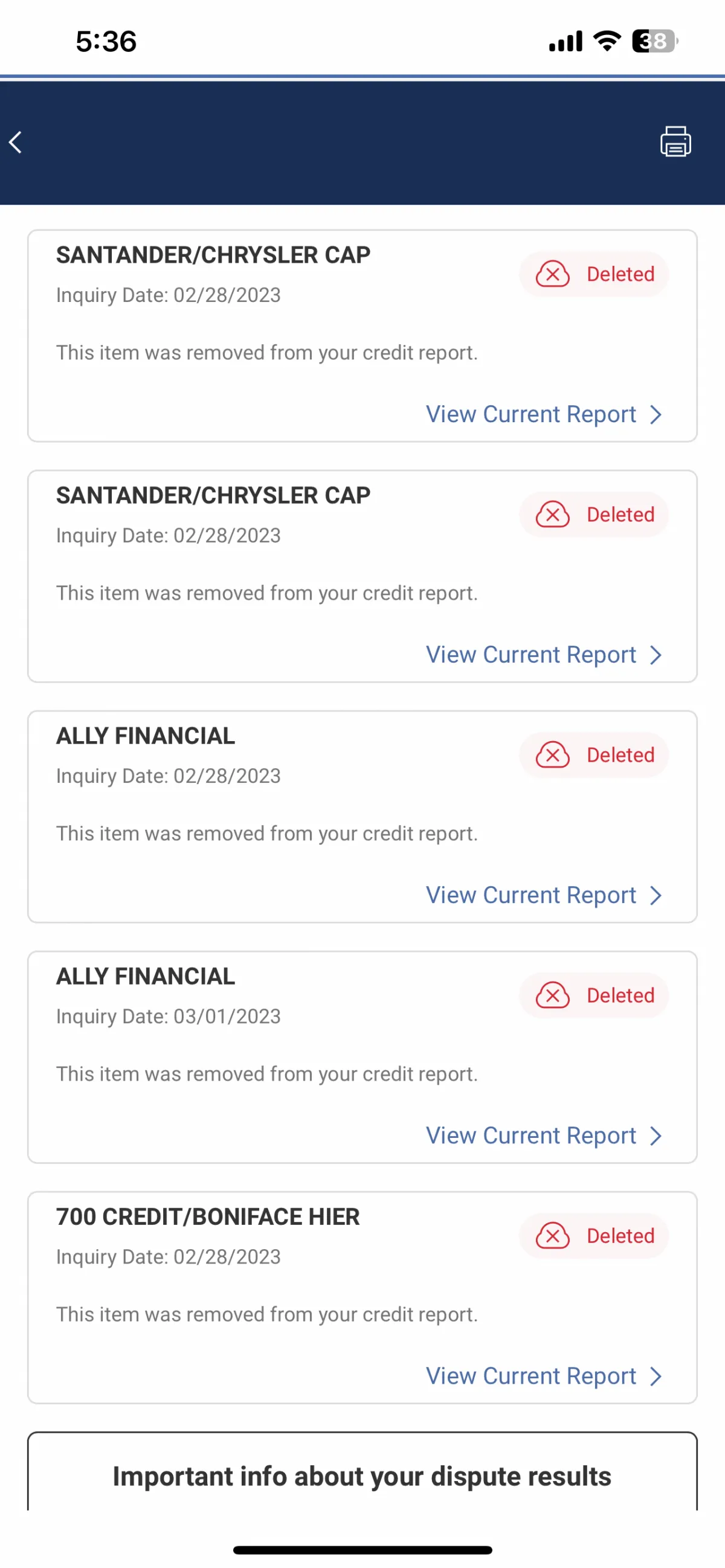

Knowing How To Attack Negative Items From Your Credit Report That Are Incorrectly Affecting Your Score Through The Credit Repair Process

How To Create Credit Scores So

Intriguing That It Stops You from Paying Higher Interest Rates For Things Like A Car Lease Or A Mortgage For A House

A complete step-by-step guide with exclusive details written by an expert with everything you need to improve your credit profile & score!

Detailed, Step-By-Step Blueprint Showing You Exactly How To Use The Steps To Build & Grow Your Credit & Business!

Unlock Your Financial Potential

Our program is designed to help individuals and businesses restore and improve their credit profiles. We provide personalized strategies, expert guidance, and proven methods to unlock financial possibilities and open doors to better opportunities. With our dedicated support, we help clients achieve their credit goals, regain control of their finances, and pave the way for long-term success.

Tired of Not Seeing Results?

Our mission is to provide you with a reliable path to credit restoration, lifting the weight off your shoulders and empowering you to reclaim control over your financial future.

With our proven strategies and personalized approach, you can break free from the constraints of bad credit and unlock the doors to a brighter financial outlook.

Get Your Personalized Credit Analysis Today

Unlock insights into your credit health and discover the path to restoration. Gain a deeper understanding of your credit situation and take the first step towards a better credit future.

PRICING TABLE

Gold Monthly Plan

$250

Enrollment/audit fee

Credit Education

3 Bureau Audit-Analysis

Monthly Updates

Monthly Advisor Call

Credit Building

No contracts

Unlimited Disputes to Transunion, Equifax, Experian, and to All Collections reporting negative and unverifiable accounts

120 DAY CREDIT SWEEP

$1,000 /

one time payment

Single Payment full Service One Time Fee

Credit Education

Credit Building and Financial Literacy Strategy Calls (Make Your Money Back By Learning How To Leverage Your Credit)

Maximize Disputes to get Results Every Round

Disputes to all 3 Credit Bureaus (Equifax, Experian & TransUnion) along with Personal Identifiers, Creditors, Collections, repos, evictions, child support and late payments (Inquiries upon request)

3 eBooks | Credit Boost Guide | Mastering Manufactured Spending | Transform Your Wealth

COUPLES

120 DAY CREDIT SWEEP

$1500 /

one time payment

Single Payment full Service One Time Fee

Credit Education

Credit Building and Financial Literacy Strategy Calls (Make Your Money Back By Learning How To Leverage Your Credit)

Maximize Disputes to get Results Every Round

Disputes to all 3 Credit Bureaus (Equifax, Experian & TransUnion) along with Personal Identifiers, Creditors, Collections, repos, evictions, child support and late payments (Inquiries upon request)

3 eBooks | Credit Boost Guide | Mastering Manufactured Spending | Transform Your Wealth

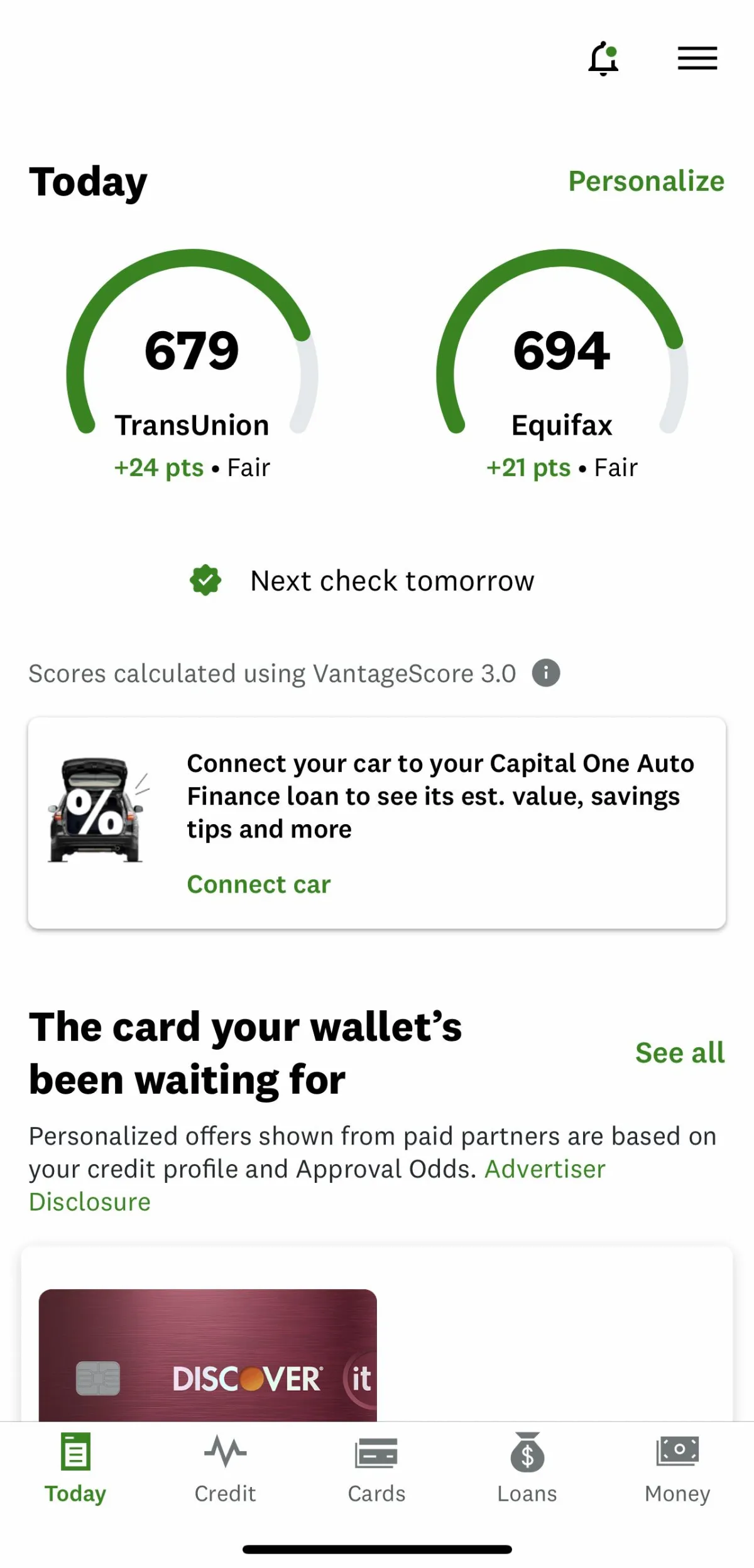

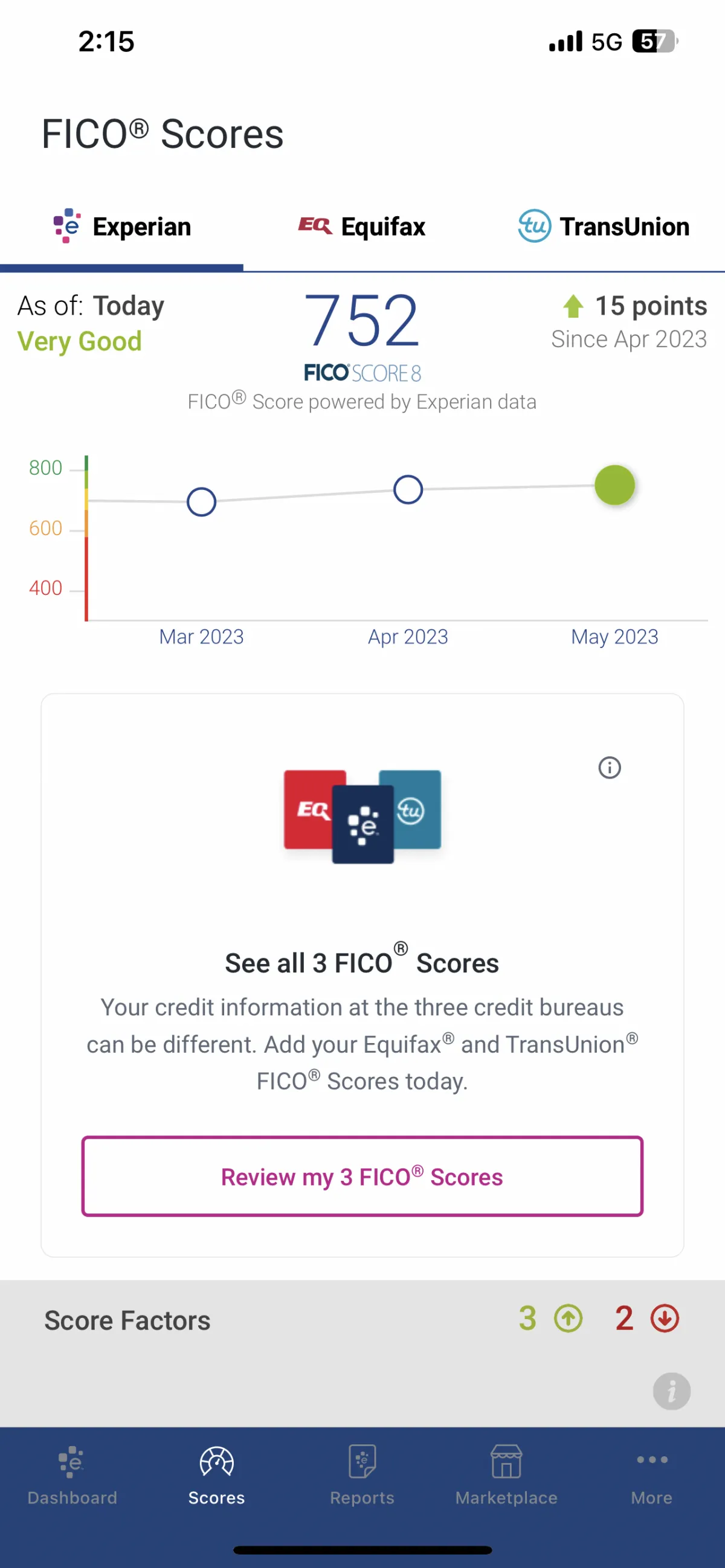

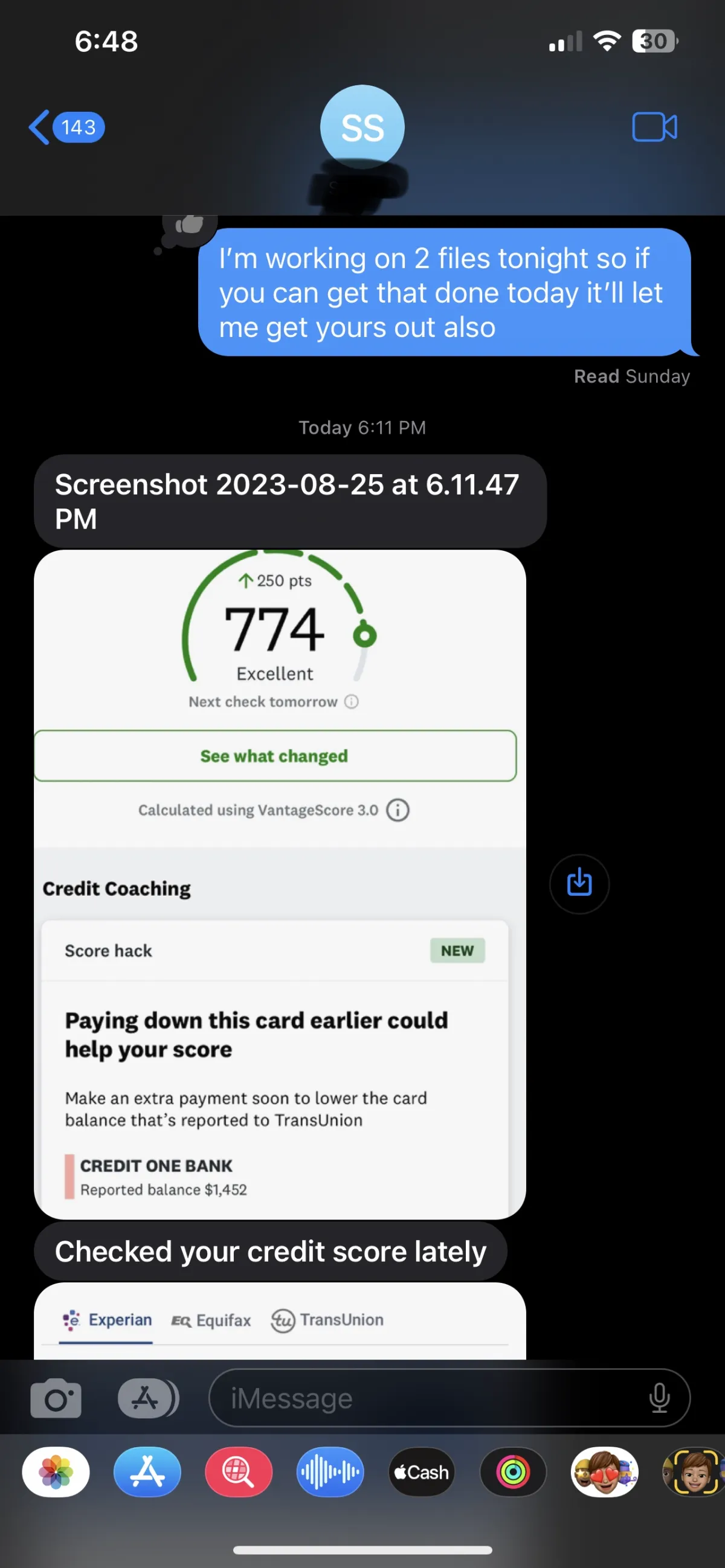

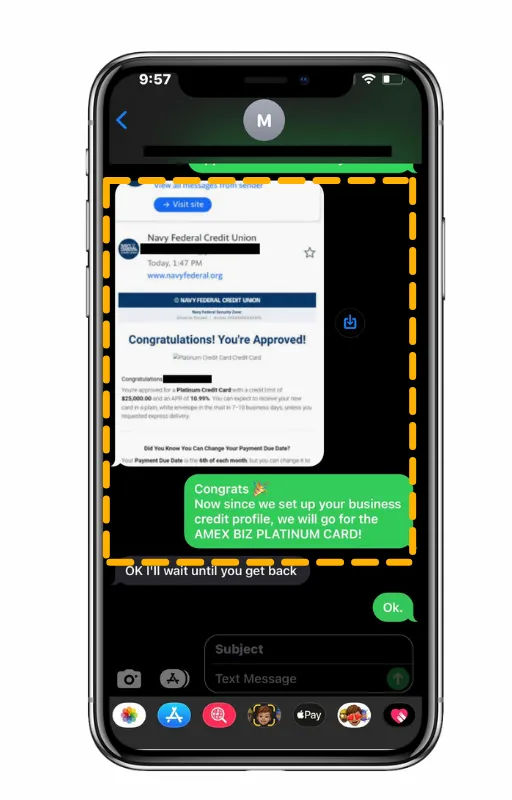

See Results People are getting from RSC Management Solution....

Unlock Ultimate Benefits With Better Credit Scores!

Right Direction

A good credit score means that banks and credit companies will approve loans with lower interest rates along with higher borrowing capacity, allowing you to save a lot of money

With Any Devices

Insurance companies factor your credit reports into your auto and home insurance application. If you have a good credit score, you will be more likely to receive lower insurance rates and save money

Real Life Project

Individuals with favorable credit reports have a better chance of securing a loan or credit card than those with low scores. Once you repair your credit, your ability to qualify for a loan will increase

Financial Vacationing Comfort

Taking advantage of the opportunity to achieve Financial Freedom in your daily life, instead of worrying about money scarcity and spending time enjoying life

Faster Rental Approval

The landlord will check the credit score reports before renting an apartment or a house. Having favorable credits leads to a better chance of securing new rentals

Frequently Asked Questions

How long does the process take to complete?

The credit repair process can take up to 3 to 6 months to a year or more to see your credit profile cleaned. However, you can see results in as little as 30 to 90 days. Every credit profile is different and so is every outcome and time frame. We work diligently to expedite the process and keep you informed about progress along the way.

Can you guarantee that my credit will be completely fixed?

Unfortunately , we can not guarantee specific outcomes or results - no one can. Our credit repair services aim to improve your credit by addressing inaccuracies and working towards the removal of negative items from your credit report. The extent of improvement will depend on individual circumstances and cooperation from creditors and credit bureaus.

What dispute method do you use? Factual? Metro 2? Pre-Litigation?

I actually employ all three of these methods of disputing. All based on the FCRA - sections 1681e, 1681i and 1681s2 particularly, the CDIA Metro2 compliance standard and consumer case law. We use the factually inaccurate, incomplete or unverifiable information that is reporting on your negative accounts to get them deleted.

How will you handle disputes with credit bureaus and creditors on my behalf?

We will handle disputes by following established legal procedures. Our experienced team will draft dispute letters based on the specific issues identified, and we will submit them to the appropriate credit bureaus and creditors. We will closely monitor the responses and take necessary actions to achieve the best possible outcome.

What happens if the credit bureaus keep verifying the disputes?

If they continue to verify inaccurate information, update information that we are not asking them to delete, ask us to provide more identification information after we already have or if they do not respond in the 30-day time period that they are supposed to, then they are using stall tactics and are actually proving that they are in violation of the FCRA. Which then gives us the standing to move forward with assisting you in submitting the necessary complaints to the various enforcement agencies and connecting you with a consumer rights attorney in your area that can help you sue the credit bureaus for up to $1,000.00 per violation.

Do I need to freeze my secondary credit bureau reports?

No. It is not necessary to freeze your secondary credit reports (LexisNexis, SageStream, LCI, Innovis, CoreLogic, ARS, etc.). Doing so does not stop the bureaus from verifying the disputes directly with the creditor or collection agency via eOSCAR and Metro2. And you cannot freeze either of these two systems. Freezing your secondary reports only stops lenders and unauthorized individuals from accessing those reports without your express authorization. And in order to apply for most new credit accounts, you will eventually need to unfreeze them anyway. Unless you are really the victim of fraud or have a hard time yourself, with applying for random credit, then I would not recommend freezing your secondary reports.

Why do I need a membership with a credit monitoring program?

We use CreditDyno because they provide us with the most accurate information when it comes to what is on your credit report. We will not work on your credit without it. Unfortunately, we cannot accept other services as they are not fully accurate. Everything we do is custom to you so we NEED to see what is on all of your reports so we can properly game plan, and provide the most accurate advice. We do not only challenge negative items, we also help you BUILD YOUR CREDIT and this is a crucial component in our plan to help you increase your score.

Can you help me establish new lines of credit or improve my credit score?

Absolutely! That’s a very important step in our program. We will provide guidance and education on credit-building strategies. We will share recommendations to help you establish positive credit habits, manage your finances responsibly, and improve your credit score over time.

What information do you need from me to start the credit repair process?

To initiate the credit repair process, we require

- Signed Service Agreement

- Credit Monitoring Details

- Proof of Address

- Identification

- Social Security Number

Is there anything I should do during this process?

Yes! I am glad you asked that question. Here’s how we can use your help to ensure youre optimizing your scores and reaching your goals quickly.

- Pay all open accounts ON-TIME moving forward

- Keep credit utilization low , below 30%. Pay BEFORE statement close date

- Don’t apply for new credit (outside of credit building recommendations)

- Forward me all responses from the Credit Bureaus

- Provide a new Proof of Address every 45 days.

Staying on top of these recommendations will ensure our process runs smoothly.